How HSAs and FSAs might help your household.

With family health insurance premiums rising 297 percent since 2000, averaging over $25,000 annually, some employees feel the squeeze. Deductibles, too, have jumped nearly 50 percent over the last decade, further increasing out-of-pocket expenses. In this environment, understanding and using Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can help families take more control of their healthcare finances.1

What Are HSAs and FSAs?

HSAs and FSAs are special accounts designed to help manage medical expenses.

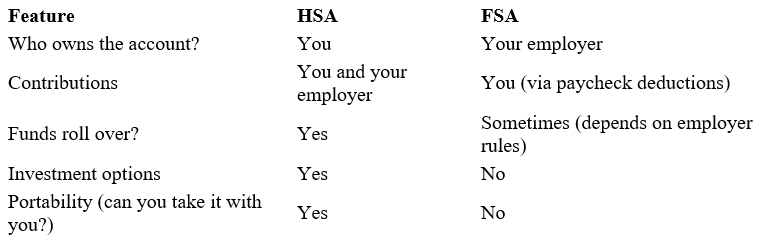

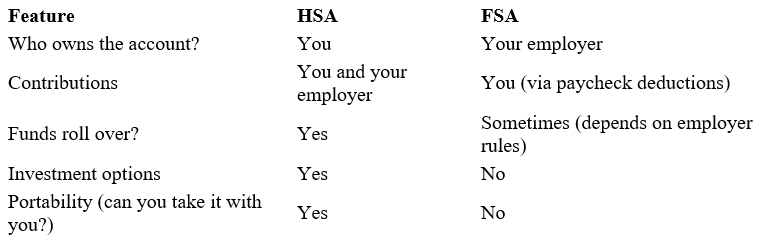

If you have an HSA, you must also be enrolled in a high-deductible health plan (HDHP). You contribute to the account, and your employer can also choose to contribute. Funds roll over from year to year.

FSAs are usually employer-sponsored accounts. You contribute pretax dollars through payroll deductions. However, the funds must typically be used within the plan year unless your employer offers a grace period or limited rollover.

Both accounts allow you to use pretax dollars to pay for qualified medical expenses, such as copays, prescriptions, or over-the-counter medications. The one that may be best for you can depend on many factors.

Key Differences Between HSAs and FSAs

Contribution Limits:

For 2025, the IRS allows individuals to contribute up to $4,300 and families up to $8,550 to an HSA. People over 55 can contribute an extra $1,000 annually. The FSA has a contribution limit of $3,300 ($6,600 for households).2,3

Why These Accounts Matter More Than Ever

Rising premiums and deductibles mean Americans are shouldering more health care costs than ever. Since 2000, workers’ out-of-pocket costs for health insurance have nearly quadrupled. Today, it takes over five weeks of full-time work to pay the employee share of premiums, and this is before a single doctor’s visit. Moreover, deductibles for families can exceed $3,700.1

Employers are also increasingly shifting healthcare costs to workers through narrower provider networks, more prior authorizations, and tiered drug pricing systems. That’s where HSAs and FSAs come in. By allowing workers to set aside pretax money, these accounts help manage healthcare costs and create a strategy for expected and unexpected expenses.

Remember that if you spend your HSA funds for non-qualified expenses before age 65, you may be required to pay ordinary income tax and a 20 percent penalty. After age 65, non-qualified expenses are taxed as ordinary income taxes on HSA funds, and no penalty applies. HSA contributions are exempt from federal income tax but not from state taxes in certain states.

Real-Life Scenarios Where HSAs and FSAs Help

- Having a Baby: New parents can face an increase in health-related costs, ranging from prenatal care and delivery to postnatal checkups and baby essentials. An FSA can help cover many of these expenses with pretax funds, whereas an HSA can carry over unused funds for future pediatric visits.

- Job Change: Moving to a high-deductible plan may make you eligible for and your HSA funds remain yours even if you switch employers or retire, making it a flexible long-term tool.

- Chronic Illness Diagnosis: Copays, prescriptions, and specialist visits add up quickly. An HSA or FSA can manage the blow, and an HSA with investment options that are available with some plans.

- Caring for Aging Parents: From prescriptions to home health aides, caregiving costs can be significant. FSAs can help cover some expenses, and for those with HDHPs, an HSA provides a long-term strategy for health-related caregiving costs.

Other HSA/FSA Tips

- Use online calculators to see what might work for you.

- Prepare for known medical expenses to use funds strategically.

- Monitor your balances online and review your list of eligible expenses.

- If you have an HSA, see if there is an investment option associated with the account.

Remember: during any qualifying life event, like marriage, a new child, or a job change, review your options because these events may allow you to enroll in or adjust your benefits outside Open Enrollment.

Final Thoughts

Understanding how HSAs and FSAs work and using them effectively can make a meaningful difference during life’s most important transitions.

If you haven’t explored these options, now may be the time to start.

1. MoneyGeek, April 29, 2025.

2. Kaiser Permanente, June 2, 2025.

3. IRS, May 29, 2025.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.