An overview of some fundamental steps when a loved one passes.

When you lose a spouse, partner, or parent, the grief can be overwhelming. In the midst of that grief, life goes on. There are arrangements to be made, things to be taken care of – and in recognition of this reality, here is a checklist that you may find useful at such a time.

First, gather documents. Ask for help from other family members if you need it. Start by gathering the following.

- A will, a trust, or other estate documents. If none of these exist, you could face a longer legal process when settling the person’s estate.

- A Social Security card/number. Generally, the person’s Social Security number will be retired shortly following the death. If you are uncertain, consider checking with the Social Security office.

Then, gather these additional highly important items.

- Any account statements

- Deeds/titles to real estate

- Car titles or lease agreements

- Storage space keys/account records

- Any bills due or records of credit card statements

- Any social media platform information, if applicable

Last, but not least, look for a computer file or printout with digital account passwords. Prior to their loved one’s passing, some family members may try to centralize all this information or state where it can be found.

In addition, see if the person left a letter of instructions. A letter of instructions is not a legal document; it’s a letter that provides additional and more-personal information regarding an estate. It can be addressed to whomever you choose, but typically, letters of instructions are directed to the executor, family members, or beneficiaries.

Next, take care of some immediate needs. One, contact a funeral home to arrange a viewing, cremation, or burial, in accordance with the wishes of the deceased.

Two, call or email the county clerk or recorder to request 10 to 12 death certificates; a funeral home director can often help you with this matter. (Counties usually charge a small fee for each copy issued.) Ten to 12 copies may seem excessive, but you may need that many while working with insurance companies and various financial institutions.

Three, if the person was still working, contact the human resources officer at your loved one’s workplace to inform them what has happened. The HR officer might need you to fill out some paperwork pertaining to retirement plans, health benefits, and compensation for unused vacation time.

Four, consider speaking with an attorney – this can be the lawyer who helped your loved one create a will or estate plan. Should your loved one die without a will, you may want to contact a lawyer for an overview of how the probate process will work and see to what degree you might become liable if your loved one had any outstanding debt obligations.

Five, resolve to keep track of any recurring debts that your loved one had set to autopay. Consider placing the monthly bills for these debts in your name (or another family member or the executor).

Notify creditors and credit card companies that were part of your loved one’s credit history. Creditors may want to know when existing debts will be paid, either by you or your loved one’s estate. You can also notify the “big three” credit bureaus – Experian, Equifax, and TransUnion – of their passing, which can usually be done online, over the phone, or by letter.

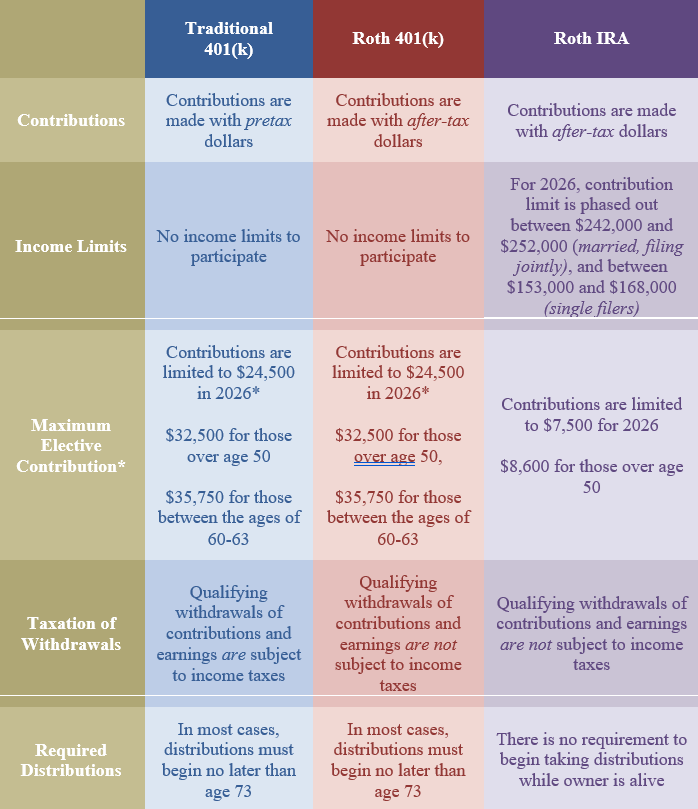

Following these steps, address financial, insurance, and credit matters. Investment and retirement plan accounts and insurance policies should have beneficiaries, so reach out to the financial and insurance professionals who helped your loved one as well as the person overseeing their workplace retirement plan. Talk with these professionals to learn about the possible tax implications from inheriting these assets.

State and federal taxes for your loved one will also need to be paid, and possibly, other taxes for the year of their death.

Remember, this article is for informational purposes only and is not a replacement for real-life advice, so make sure to consult your tax, legal, and accounting professionals before modifying your any tax or estate strategy.

If your loved one owned a small business or professional practice, a discussion with business partners (and clients) may be necessary as well as a consultation with the attorney who advised that business.

Look after your future. Working through several of these issues may help bring closure to your loved one’s estate.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.